Benefits of using trusts

Navigating the Maze: A Comprehensive Guide to Trusts.

Trusts offer a flexible way to manage assets for the benefit of others. But with this flexibility comes a complex web of tax implications. This comprehensive guide will equip you with the knowledge to understand trusts, their various types, tax considerations, and registration requirements.

What is a Trust?

A trust is a legal arrangement where one person (the settlor) transfers ownership of assets (money, property, investments) to another person (the trustee). The trustee then holds and manages those assets for the benefit of a designated beneficiary (or beneficiaries). The settlor outlines their wishes in a trust deed, which becomes the blueprint for the trustee’s actions.

Highlights

Trust advice services are referred to a third party. Neither Your Property Financial nor PRIMIS are responsible for the service received. These services are not regulated by the Financial Conduct Authority and may have limited consumer protection.

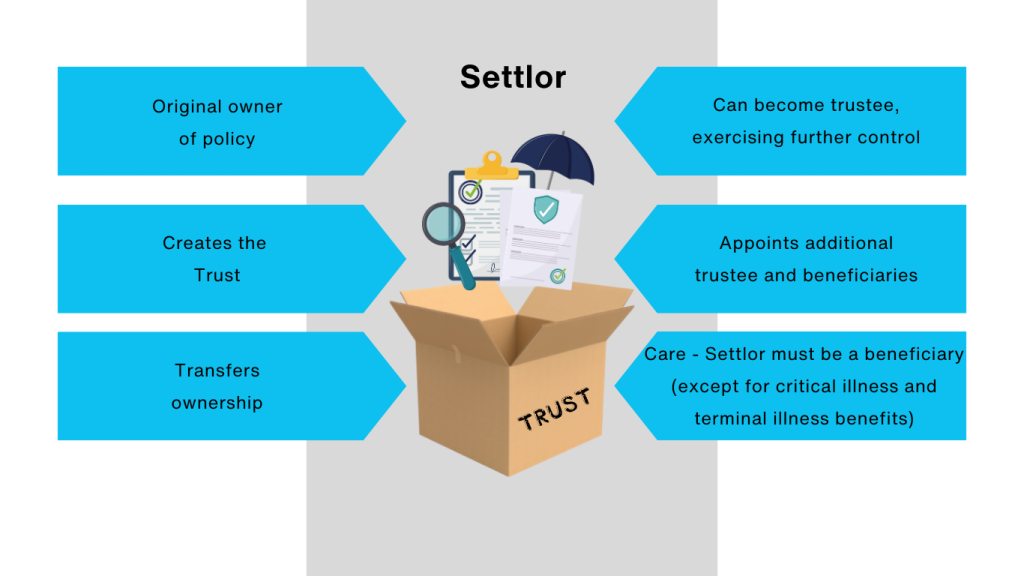

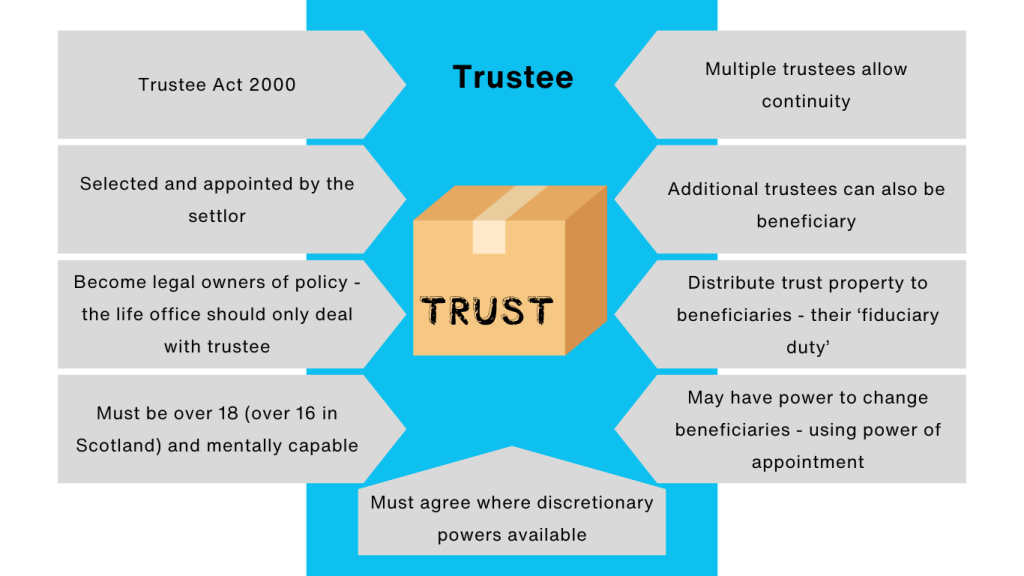

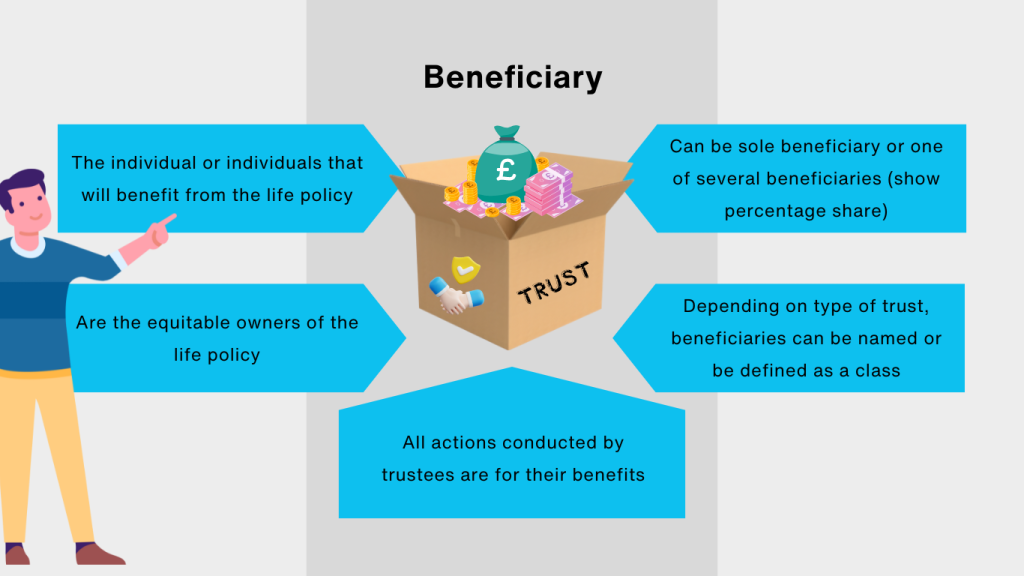

Key Players in a Trust

- Settlor: The person who creates the trust and transfers assets to it.

- Trustee: The individual or entity responsible for managing the trust assets according to the settlor’s wishes.

- Beneficiary: The person(s) who ultimately benefit from the trust assets.

Types of Trusts

The legal system recognises various types of trusts, each with its own tax treatment. Here are some common ones:

Bare Trusts: The simplest form, where the beneficiary has an immediate and absolute right to the trust assets.

Interest in Possession Trusts: The beneficiary receives income from the trust assets, but may not have immediate access to the capital itself.

Discretionary Trusts: The trustee has the discretion to decide how and when to distribute income and capital to the beneficiaries.

Accumulation Trusts: Income generated by the trust assets is reinvested rather than distributed to beneficiaries.

Mixed Trusts: A combination of the above types offers more flexibility.

Settlor-Interested Trusts: When the settlor retains some benefit from the trust, such as the right to reside in a property held within the trust.

Non-Resident Trusts: Established or administered outside the UK.

What are Trusts Used For?

Trusts offer a variety of benefits, including:

Providing for Vulnerable Beneficiaries: Ensuring the well-being of beneficiaries who may not be able to manage their own finances.

Estate Planning: Transferring assets to beneficiaries in a tax-efficient manner and reducing inheritance tax liability.

Asset Protection: Shielding assets from creditors or future relationship breakdowns.

Financial Management for Minors: Managing assets for children until they reach a certain age.

Parental Trusts for Children

Parental trusts are a popular option for planning the future of your children. Assets held in a trust for a child can be used for their education, first home purchase, or other purposes as specified in the trust deed. These trusts can be beneficial for tax reasons, potentially reducing your child’s future inheritance tax liability.

Trusts and Income Tax

The tax treatment of trusts in terms of income tax depends on the type of trust and its income sources. Generally:

- Basic Rate Tax: Most trusts pay income tax on income exceeding £500 (as of April 2024).

- Higher Rates: Depending on the trust type and income level, higher income tax rates may apply.

- Tax-Free Allowances: Trusts may not benefit from certain tax-free allowances available to individuals.

Trusts and Inheritance Tax

Trusts can be a valuable tool in reducing inheritance tax liabilities. This depends on factors like:

- The Type of Trust: Bare trusts typically don’t offer inheritance tax benefits, while discretionary trusts may.

- The Timing of Transfer: Assets transferred to a trust 7 years before death are generally outside the inheritance tax net.

When Must You Register a Trust?

Not all trusts require registration with HMRC (HM Revenue & Customs). However, registration is mandatory for certain types of trusts, including:

Trusts with a UK resident settlor and non-resident beneficiaries.

Trusts with a value exceeding £5,000 that acquire UK residential property.

What if there is no will?

- Someone has to apply for ‘Letters of Administration’

- Same process as for ‘Grant of Probate/Confirmation’

- The Rules of Intestacy are complex and vary across England and Wales, Scotland and Northern Ireland

- Visit gov.uk/inherits-someone-dies-without-will to find out who is entitled to a share of someone’s money, property and possessions if they die without making will

Seeking Professional Advice

Trusts and their tax implications can be complex. It’s crucial to seek professional legal and financial advice before setting up a trust. They can guide you on the most appropriate type of trust for your needs, ensure the trust deed accurately reflects your wishes, and advise on potential tax implications.

Making Your Trusts Journey Smooth

- This guide provides a general overview. Specific tax treatment and regulations may change.

- HMRC provides detailed information on trusts and taxes on their website https://www.gov.uk/trusts-taxes.

- Consider seeking professional advice to create and manage a trust effectively.

Conclusion

Trusts offer a powerful tool for managing assets and planning for the future. However, navigating the tax implications is crucial. By understanding the different types of trusts, their uses, and the