Low credit score mortgage

Check out our brief credit score video below 👇🏾

Worried about getting declined for a mortgage?

It’s very easy to get declined for a mortgage if your credit score isn’t near perfect and once you’ve been rejected you will find it even harder to get approved as other lenders will see these declines.

At Your Property Financial, we have access to the lenders who can consider your application and have direct communication with the decision-makers at the banks to make sure you get approved quickly and we have a success rate of 96% on approval at first application.

👉🏽CONTACT US NOW. TO GET YOUR MORTGAGE APPROVED

Mortgage lenders too often don’t fully consider all the facts about your situation, or worse, just let the computers make the decisions, which can lead to you getting declined!

Factor in any late payments, defaults, or other credit issues you may have had and you’re going to find it hard to get approved by a mortgage lender.

Avoiding being declined is crucial as if you get rejected more than a few times, it can harm your credit rating even more, which could lead to you not getting a mortgage and therefore, losing out on your dream home or better mortgage rates.

Highlights

Did you know several factors can impact your credit score?

The first thing lenders will check when considering your mortgage application is your credit score. This will show your payment history, current debt levels and account conduct. There are numerous reasons you can have a low credit score:

⚪️ Late payments.

⚪️ Arrears.

⚪️ Defaults.

⚪️ Debt Management Plans.

⚪️ Overall outstanding debt.

⚪️ Not on electoral register.

⚪️ Debt to income ratio.

⚪️ Debt vs credit limit ratio.

⚪️ Type of debt outstanding.

⚪️ County Court Judgements.

⚪️ Past or current Payday loans.

⚪️ IVA / Bankruptcies.

👉🏽CONTACT US NOW. TO GET YOUR MORTGAGE APPROVED

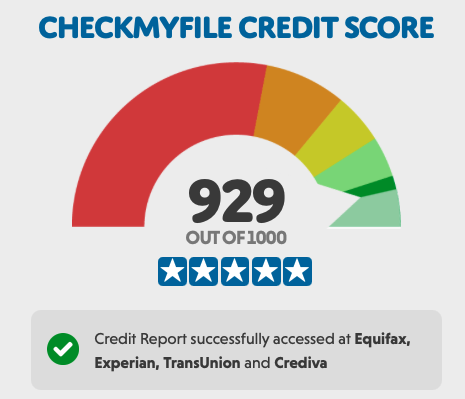

Your Credit Score

We have got access to lenders who can help regardless of your credit score!

Your credit score is one of the first things a potential lender will look at when considering whether to lend to you.

Often the lender will use different credit rating agency data and even their own credit scoring system to make a decision on whether to lend to you.

Therefore it’s very important you have expert mortgage advice to ensure you only proceed with a lender who is likely to accept your credit score and credit data.

4 benefits of having a good credit score before you buy a home:

- Save Big on Interest: A good credit score qualifies you for lower interest rates on your mortgage. This can translate to significant savings over the life of your loan. For instance, a small difference in interest rate can mean tens of thousands of pounds saved over the term of the mortgage.

- Unlock More Loan Options: With a strong credit score, you’ll have access to a wider range of mortgage products and lenders. This gives you more flexibility to shop around and find the best deal for your needs.

- Qualify for a Larger Loan: A good credit score can potentially increase the amount of money you can borrow. This could allow you to afford a more expensive property or give you more breathing room with your down payment.

- Smoother Application Process: A good credit score generally means a faster and smoother mortgage application process. Lenders are more likely to approve your application quickly when you have a strong credit history.

Don’t lose your dream home or get declined for a mortgage anymore

We have a 96% success rate with our applications for our clients who have poor credit.

Many lenders we have access to don’t even consider your credit score and take a more human approach to understand what the reason for the low score is and the specifics that led to that.

We find the perfect fit for your circumstance and the best lender who can consider your application.

Getting a mortgage with past credit issues or low score can be tricky, but we’re here to help you and are well-connected with lenders who can consider your application so as to make sure we can get you the best terms available and keep your payments low.

Your broker here to help

Lenders have very strict criteria, which you either fit or you don’t, this is where your mortgage broker really comes into play as they know the lender’s policy inside out and will make sure your application is submitted to the most suitable lender who can consider your circumstance and help you get approved quickly. Your mortgage broker will deal with the lender directly and will present your application in the best possible light; increasing your chances of acceptance on your first application.

Receiving expert mortgage advice

Your mortgage broker will help you get approved the first time you apply and will be able to potentially arrange a bespoke mortgage just for you with the lender if your circumstances aren’t straightforward.

Your mortgage broker deals with 90+ lenders every week so knows them very well and will have just the right lender for your needs.

First things first, you should arrange to speak to a mortgage broker who is able to help you navigate your current options and consider the different solutions to improving your credit score and/or what your mortgage options will be considering your current credit score and circumstance.

Your mortgage broker will have access to lenders who can help and in some cases lenders who don’t even look at your credit score.

Why choose us

We’re experts in the field

✅ Our team of brokers are specialists in helping when your credit score is low or you’ve had past credit problems as we have access to the lenders who can consider your mortgage application.

Access to the Banks

✅ Access to over +90 lenders so you will get the most suitable rates and terms available with many of these lenders not available on the high street which are exclusive to brokers.

Relationships

✅ Real relationships with the lenders so we can get your application pre-approved if your situation isn’t straightforward. Plus your mortgage broker is there to answer all the questions you may have.

Rapid solutions

✅ We’re quick, on our first call we will quickly establish your options and let you know the next steps so we can arrange everything promptly for you.

If you prefer to speak face-to-face we can also arrange a video call.

Making Your Low Credit Score Mortgage Journey Smooth

What is a bad credit score?: https://www.experian.co.uk/consumer/guides/bad-credit-score.html