Shared Ownership

Navigating the Maze: Share Ownership and Mortgage Broker Help for Property Acquisition

The dream of owning a piece of real estate can be incredibly exciting. However, the process can be overwhelming, especially when considering options like shared ownership and navigating the world of mortgage brokers. This guide will delve into these two aspects, helping you make informed decisions for your property journey.

Shared ownership is a great way to get onto the property ladder if you don’t have a large deposit available but can afford the typical payments relative to the property you’re considering.

As the name implies you purchase a “share” of the property, to begin with, typically starting at 25% and then have the opportunity to buy more “shares” in the property at a later date of your choosing.

You pay a subsidies rent on the share you don’t own and as these properties are typically apartments you will normally pay the service charges applicable to the property in question also.

Shared Ownership: Owning a Part of the Dream

Shared ownership, also known as co-ownership or fractional ownership, allows you to purchase a portion of a property, typically between 25% and 75%. You pay rent on the remaining portion to a housing association or a private landlord.

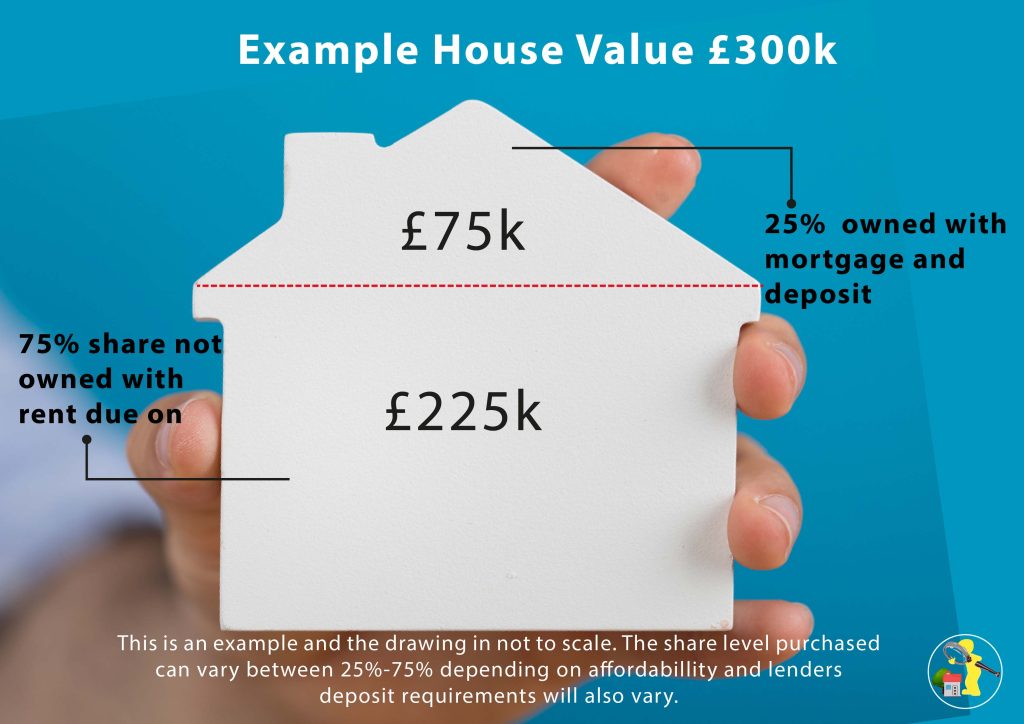

Let’s look at an example.

Example of Shared Ownership mortgage:

Property full market value of £300,000

You purchase a 25% initial share of £75,000 and pay a small rent on the remaining 75% or £225,000 you don’t currently own

You put down a 15% deposit on the 25% share you’re buying ie £11,250 (You can sometimes put down just a 5% deposit)

Therefore you require a 85% mortgage of £63,750 on your 25% (£75,000) share

In an example rate of 2% over 35 years the monthly mortgage payment could be approx £210 pcm.

The remaining 75% you don’t own yet you will pay a reduced rent on which is typically 2.5% of the value so in this example, it would be just under £470 pcm

So your total payments would be £210 mortgage + £470 rent= £680 pcm.

Now, of course, there will be other expenses on top of this like your utility bills, council tax, service charge and ground rent.

Now all further increases in the property value for the share you own, so in this example, 25% is your equity. So if the property went up in value to £400,000 your 25% share would now be worth £100,000.

Complete your details below and we’ll be in touch to help you with your enquiry

(Takes less than 30 seconds)

Staircasing

To increase your ownership in the property is something called “Staircasing” where you essentially buy another percentage of the property.

Remember a valuation would be performed at the time and this is first performed by the company who sold you the first percentage and if the property has gone up in value you would be buying the new extra percentage of ownership at the new increased valuation. The same is true of course if the property goes down in value, you could then buy extra percentages at a reduced price; albeit your own equity could have been reduced too so in practice it may not be possible.

So on the above example of the property now being worth £400,000 and let’s say you wished to buy another 25% things would look like the following.

£400,000 new valuation.

Original 25% share worth £100,000.

Original mortgage is now only £50,000 due to the payments you’ve made towards this.

The new share to be purchased of 25% is £100,000 + old share mortgage of £50,000 means is a total mortgage of £150,000.

You now own 50% (Your original 25% plus your newly purchased 25%) of the £400,000 property i.e. £200,000 is now your total share value.

£150,000 mortgage into a £200,000 50% percentage value would mean you would need a mortgage for 75% loan to value.

In this example, your mortgage payments would increase naturally as you now own more of the property but your rent figure for the share you don’t own would decrease.

Summary

Shared ownership is a great way to acquire an affordable percentage in a property and then over time as you save up more deposit, income increases and you make your payments over the years naturally you can then acquire more of the property until you eventually own 100%.

Of course, you don’t have to buy the full 100%, you could just buy the first initial 25% and then sell that to someone and you need not ever need a staircase to buy further amounts.

One interesting tax consideration is that you only pay the full stamp duty amount when your ownership goes over 80% ownership albeit there is still a nominal stamp duty payment for the more expensive properties for the share you don’t yet own. This is of course where your solicitor will be able to confirm the exact stamp duty amount due so always get this confirmed before making any decisions, as tax is specific to your own individual circumstance. With careful planning though you can mitigate your tax bill.

There are a lot of areas to consider when looking at shared ownership and it may be that there are more traditional routes available to you so it is important to speak to a mortgage broker who can walk you through all of your options.

The Mortgage Broker: Your Guide Through Loan Options

A mortgage broker acts as an intermediary between you and potential lenders. They work with various lenders to find the mortgage product with the most suitable interest rate and terms for your financial situation.

Benefits of Using a Mortgage Broker

Wide range of options

Brokers have access to products from multiple lenders, increasing your chances of finding the best deal.

Expertise and guidance

A good broker will understand your financial situation and guide you through the complex mortgage application process.

Negotiation power

Brokers can leverage their relationships with lenders to negotiate favourable interest rates on your behalf.

Working Together: Shared Ownership and Mortgage Broker Synergy

Shared ownership and mortgage brokers can work hand-in-hand to help you achieve your property goals. Here’s how:

- Understanding affordability: Brokers can assess your financial situation and determine the maximum shared ownership share you can afford while considering the ongoing rent payments.

- Finding the right mortgage: With their knowledge of shared ownership mortgages, they can identify the best product with competitive rates and terms.

- Streamlining the process: Brokers can handle much of the paperwork and communication with lenders, simplifying the application and approval process.

Complete your details below and we’ll be in touch to help you with your enquiry

(Takes less than 30 seconds)