Benefits of Green Mortgages

Going Green with Your Mortgage: Benefits and Advantages for Eco-Conscious Homeowners

The UK’s housing market is undergoing a transformation, with a growing focus on sustainability and energy efficiency. This trend extends to the world of mortgages, where lenders are increasingly offering green mortgages to incentivise eco-conscious homeownership. But what exactly are green mortgages, and what advantages do they offer?

Understanding Green Mortgages

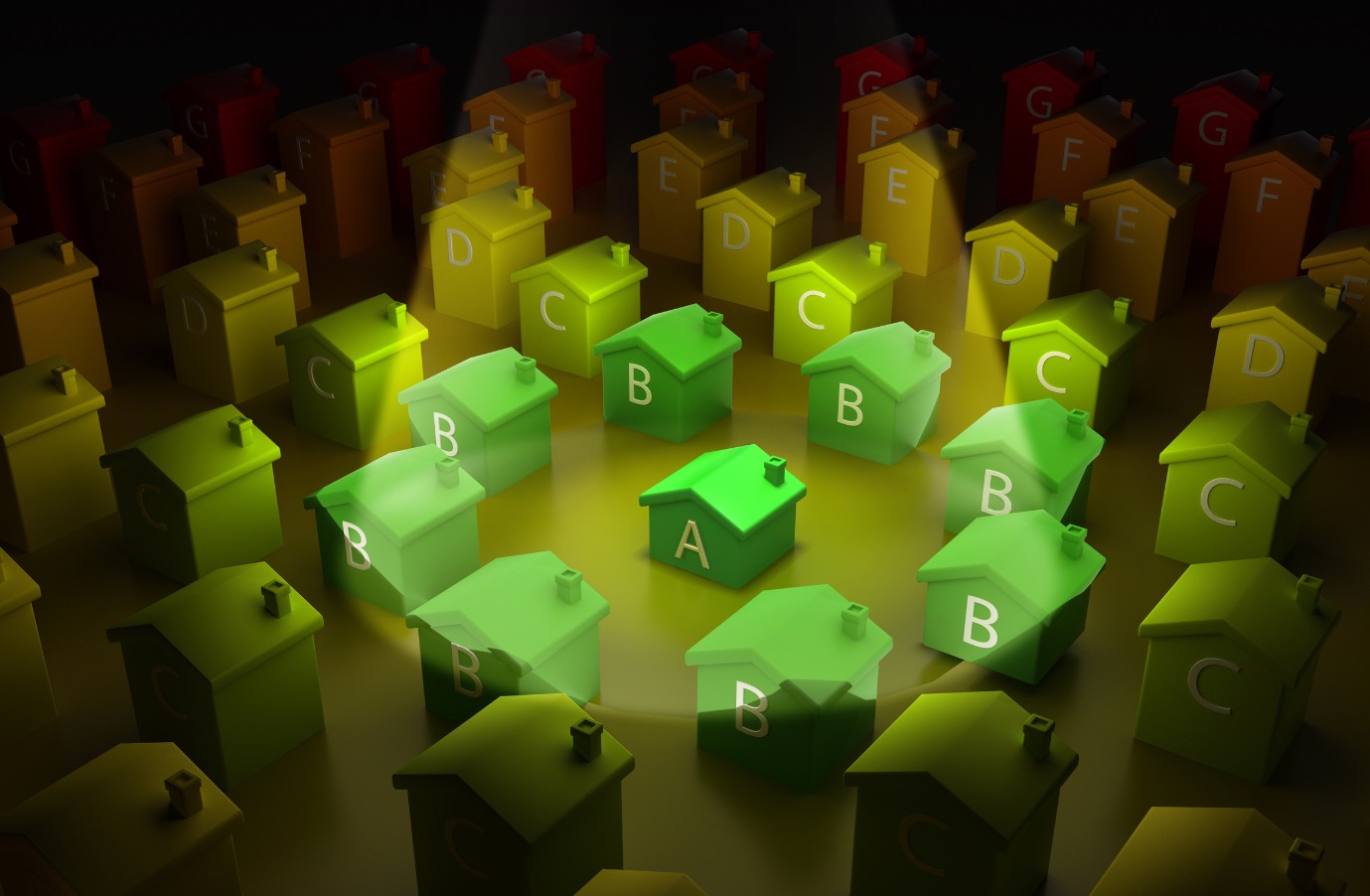

A green mortgage is a loan specifically designed for energy-efficient properties. These mortgages reward buyers who purchase homes with high Energy Performance Certificate (EPC) ratings, typically A or B. The EPC is a government-issued document that measures a property’s energy efficiency, grading it from A (most efficient) to G (least efficient).

Unlocking the Green Advantage

Green mortgages offer a compelling combination of financial and environmental benefits:

Reduced Interest Rates: The primary advantage of a green mortgage is the potential for a lower interest rate compared to a standard mortgage. This translates to significant savings over the life of your loan, making eco-friendly living more affordable.

Cashback Incentives: Some lenders entice borrowers with cashback bonuses upon taking out a green mortgage. This extra cash can be used towards renovations that further improve your home’s energy efficiency, creating a positive feedback loop.

Increased Property Value: Energy-efficient homes are demonstrably in higher demand. Studies suggest that eco-friendly properties sell faster and for a premium compared to their less efficient counterparts. Green mortgages can thus be an investment in your property’s long-term value.

Environmental Contribution: By choosing a green mortgage and an energy-efficient home, you’re actively contributing to a greener future. Reduced energy consumption translates to lower carbon emissions, playing a role in combating climate change.

4 Green Advantages: A Deeper Dive

Here’s a closer look at the four key advantages of green mortgages:

- Financial Savings: Lower interest rates on green mortgages can lead to substantial cost savings over the life of your loan. Let’s consider an example: Imagine a borrower takes out a £200,000 mortgage with a 2.5% interest rate for a 25-year term. Compared to a standard mortgage with a 3% interest rate, the green mortgage translates to a total saving of over £16,000!

- Long-Term Investment: Energy-efficient homes cost less to run. Lower energy bills translate to significant savings over time, boosting your overall financial well-being. Additionally, the potential for increased property value due to eco-credentials makes a green mortgage an investment that pays off in the long run.

- Future-Proofing Your Home: As the UK strives towards a more sustainable future, stricter energy efficiency regulations are on the horizon. Green-rated homes are likely to be more compliant with these regulations, potentially avoiding costly upgrades down the line.

- Positive Environmental Impact: Every green mortgage taken out contributes to a more sustainable future. By opting for an energy-efficient home, you’re actively reducing your carbon footprint and promoting responsible resource consumption.

The Role of Mortgage Brokers

Navigating the mortgage market can be complex, and green mortgages are a relatively new concept. Here’s where a qualified mortgage broker can be invaluable:

Expertise in Green Mortgages

A good broker will stay up-to-date on the latest green mortgage offerings from various lenders. They can help you compare different products and find the one that most suits your needs and financial situation.

Tailored Advice

A broker can assess your individual circumstances and recommend the most appropriate green mortgage options. They can also guide you through the application process and ensure you have all the necessary documentation.

Negotiation Power

Mortgage brokers often have strong relationships with lenders, allowing them to negotiate better interest rates and terms on your behalf. This can further amplify the financial benefits of a green mortgage.

Conclusion

Green mortgages offer a win-win situation for homeowners and the environment. By choosing an eco-friendly home and a green mortgage, you can save money, improve your property’s value, and contribute to a more sustainable future. With the help of a qualified mortgage broker, navigating the path to green homeownership becomes easier and more rewarding.

Making Your Green Mortgage Journey Smooth

The UK offers a growing landscape for green mortgages. Here are some additional resources to help you on your journey:

-

- Energy Performance Certificate (EPC) Register: https://www.gov.uk/find-energy-certificate – Check the EPC rating of potential properties.

- Energy Saving Trust: https://energysavingtrust.org.uk/ – Provides resources and advice on improving home energy efficiency.