Critical Illness Insurance

Critical Illness Insurance: Your Financial Safety Net

Critical Illness Insurance can provide significant assistance in the event of a critical or serious illness, such as cancer, heart attack, or stroke. The coverage comes in the form of a lump sum payment, which can be utilised to pay off or partially pay off a mortgage, cover lost earnings for a specific period, or even fund private medical treatment.

What is Critical Illness Insurance?

Critical illness insurance is a type of insurance policy that provides you with a lump sum payment if you’re diagnosed with a serious medical condition. The money can be used for anything you need, whether it’s medical expenses, adapting your home, or maintaining your lifestyle.

Why Do I Need It?

A critical illness can have a devastating financial impact. Medical treatments, lost income, and adaptations to your home can quickly add up. Critical illness insurance provides a financial cushion during a difficult time, allowing you to focus on your health and recovery.

Let’s look at an example of just some of the Critical Illness you can protect against:

Aorta graft surgery • Aplastic anemia • Bacterial meningitis • Benign brain tumour • Blindness • Brain injury due to trauma, anoxia or hypoxia • Cancer • Cardiac arrest • Cardiomyopathy • Coma • Creutzfeldt-Jakob Disease • Deafness • Dementia including Alzheimer’s disease • Encephalitis • Heart attack • Heart valve replacement or repair • Kidney failure • Liver failure • Loss of use of hand or foot • Loss of speech • Major organ transplant • Motor neurone disease • Multiple sclerosis • Parkinson’s disease • Pulmonary hypertension • Respiratory failure • Specified heart surgery • Spinal stroke • Stroke • Systemic lupus erythematosus • Third-degree burns Surgical treatment Total and Permanent Disability Benign spinal cord tumour • Cauda equina syndrome • Heart failure • Intensive care • Interstitial lung disease • Myasthenia gravis • Necrotising fasciitis • Neuromyelitis optica • Parkinson’s plus syndromes • Peripheral vascular disease • Primary sclerosing cholangitis • Pulmonary artery surgery • Removal of an entire lung • Removal of an eyeball • Severe Crohn’s disease • Syringomyelia or syringobulbia • Ulcerative colitis.

Each insurance provider has its own set of terms and conditions of what it does and doesn’t cover, and the specific conditions under which a claim would be payable and this information should be read carefully to ensure you’re aware of the critical illnesses covered under the terms and conditions of your policy. The above critical illnesses noted are just for examples purposes and the exact conditions you’re covered for are always noted in your policy documents.

Top 3 Illnesses for Critical Illness Payouts

Disclaimer: While these are the most common claims, the specific payout rates can vary between insurers. It’s essential to compare policies and consider your individual circumstances when choosing critical illness insurance.

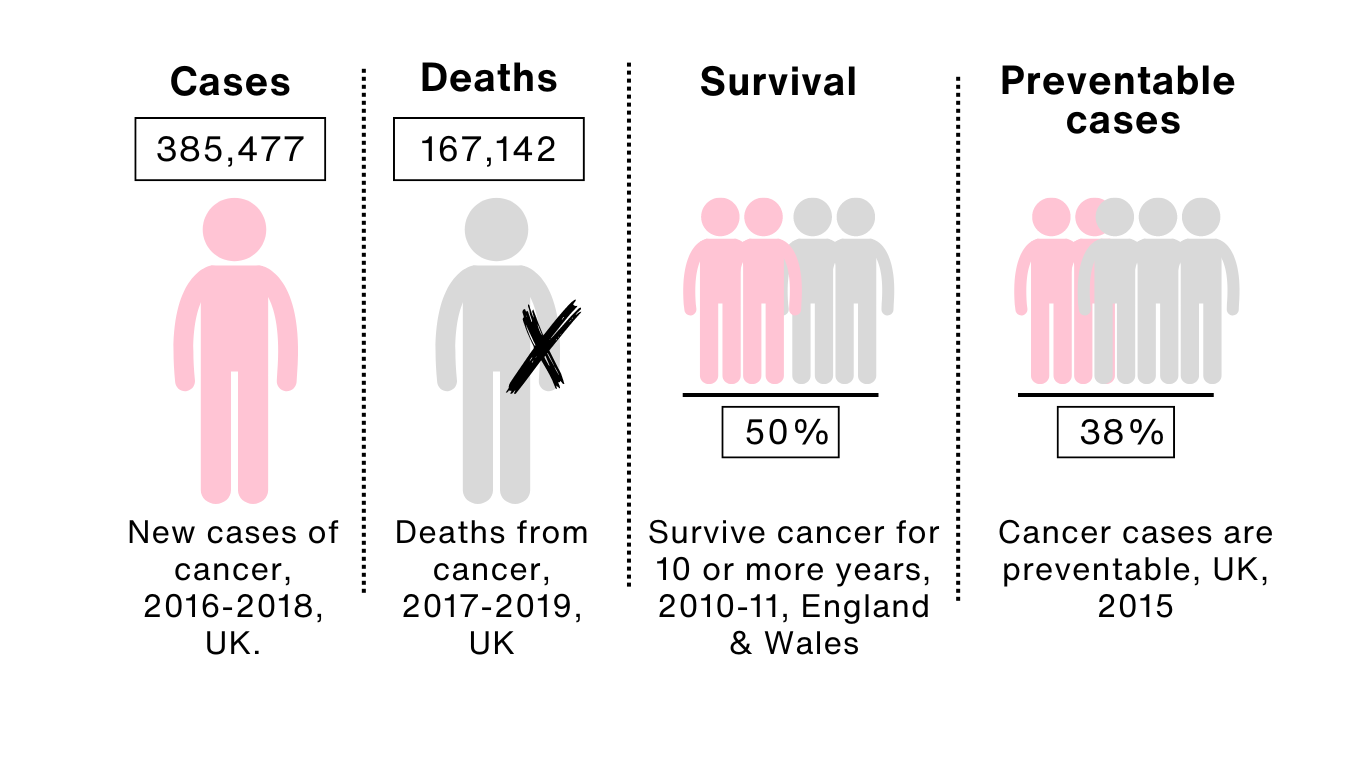

Cancer

Cancer is by far the most common reason for claims on critical illness insurance policies. The payout amount often depends on the stage and type of cancer.

*Source of information: Cancer Research UK

https://www.cancerresearchuk.org/health-professional/cancer-statistics-for-the-uk#heading-Zero

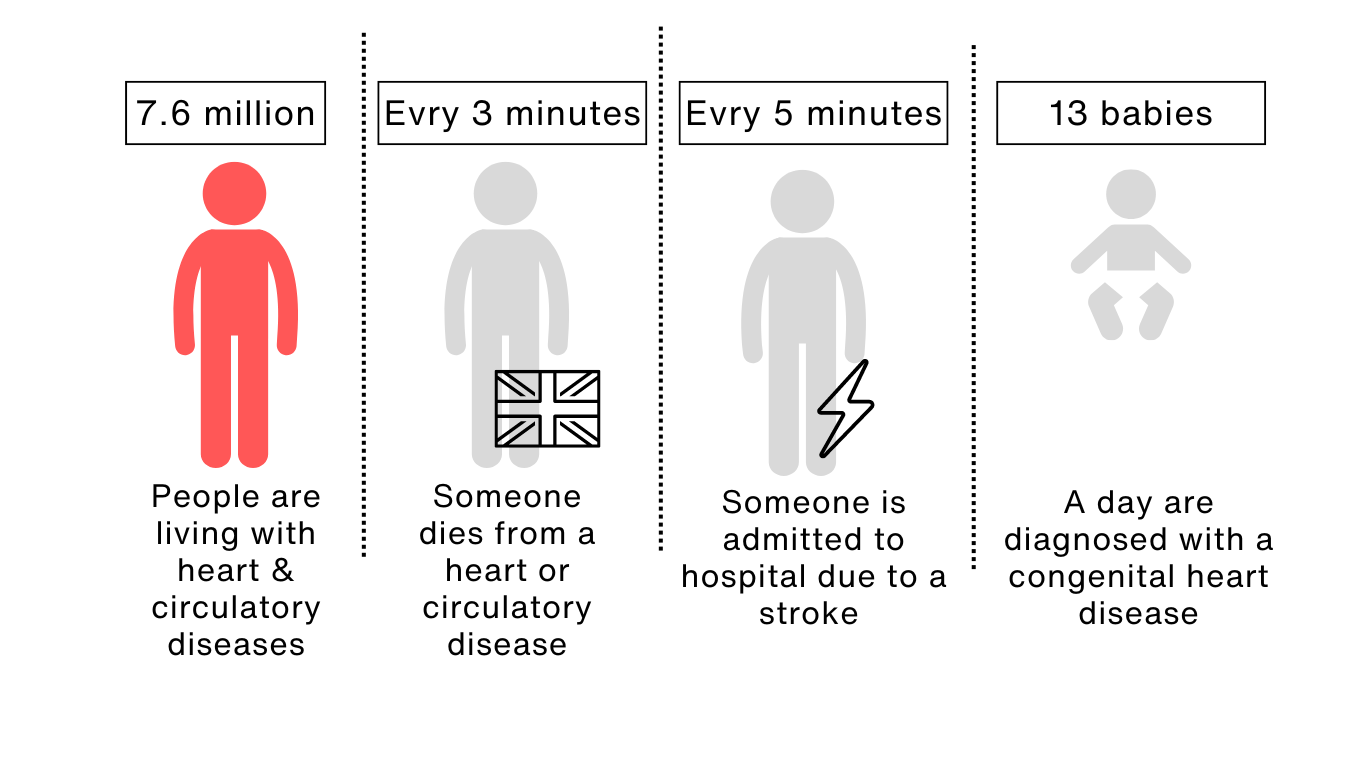

Heart Attack

Heart attacks are another leading cause of claims. The severity of the heart attack can influence the payout.

*Source of information: British Heart Foundation

https://www.bhf.org.uk/what-we-do/news-from-the-bhf/contact-the-press-office/facts-and-figures

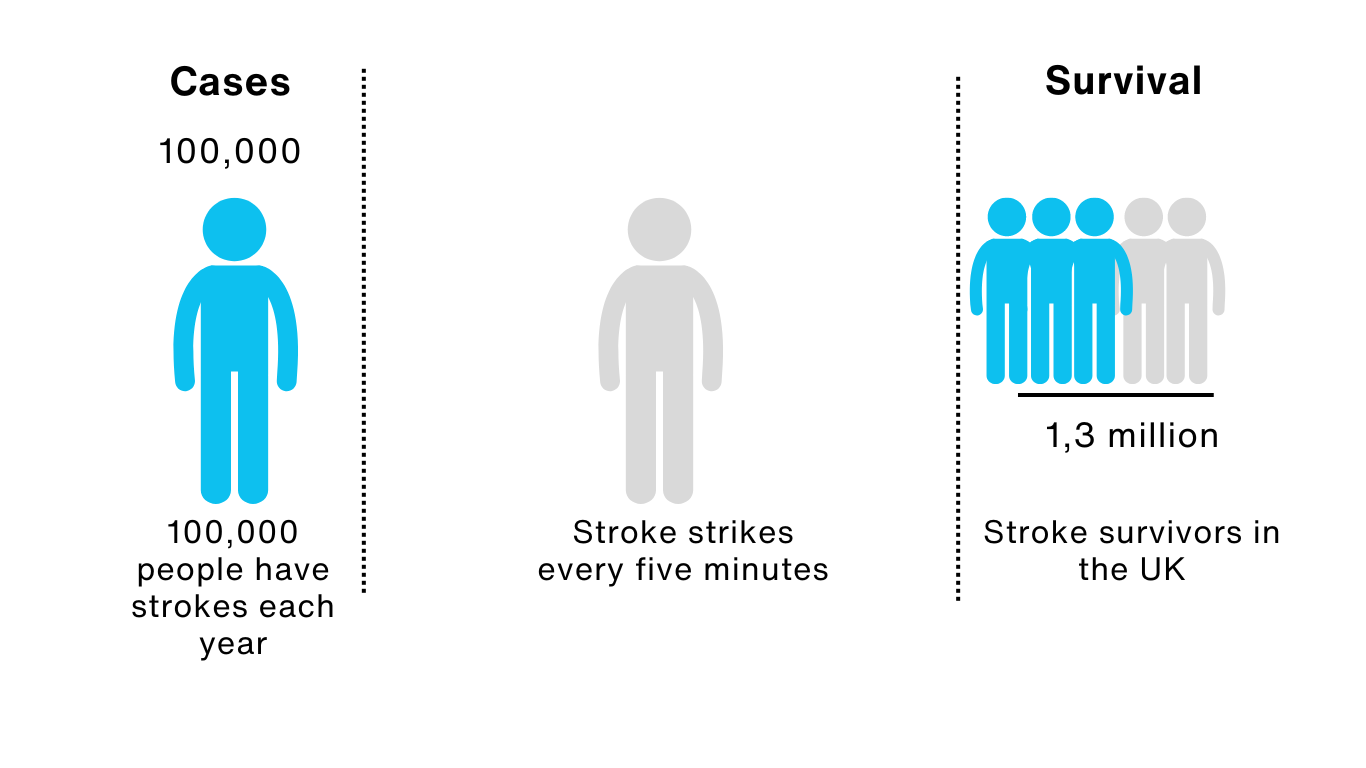

Stroke

Stroke is the third most common illness leading to critical illness insurance payouts. Similar to heart attacks, the severity of the stroke will impact the claim.

*Source of information: Stroke Association

https://www.stroke.org.uk/stroke/statistics

Remember: This is just a general overview. It’s essential to carefully read the policy terms and conditions to understand exactly what is covered. Consulting with a financial advisor can also help you determine if critical illness insurance is right for you and which policy most suits your needs.

As an insurance broker, we have access to exclusive protection terms from top insurers in the market. Our brokers can offer expert advice on the most suitable coverage options to consider.

Your mortgage broker is also an insurance broker and deals with a comprehensive range of the top insurers and will be able to advice you accordingly.

Why choose us

Access to all the top insurers – Comprehensive range of options!

Exclusive rates – not available on the high street special deals!

Insurer relationships – Existing medical issues? We can help!

We structure a completely bespoke protection package to suit your needs!