Ever heard of an offset mortgage?

Offset Mortgages: Saving on Interest with a Smart Mortgage Strategy

For many homeowners, the mortgage is the biggest outgoing cost they face each month. But what if there was a way to reduce the interest you pay and save money on your overall repayments? Enter the offset mortgage, a clever financial tool that leverages your savings to bring down your mortgage interest

Check out our brief video below ⬇️

Many people haven’t heard of the offset mortgage yet, but it still remains one of the most cost-effective ways to have your mortgage set up and has multiple benefits to you.

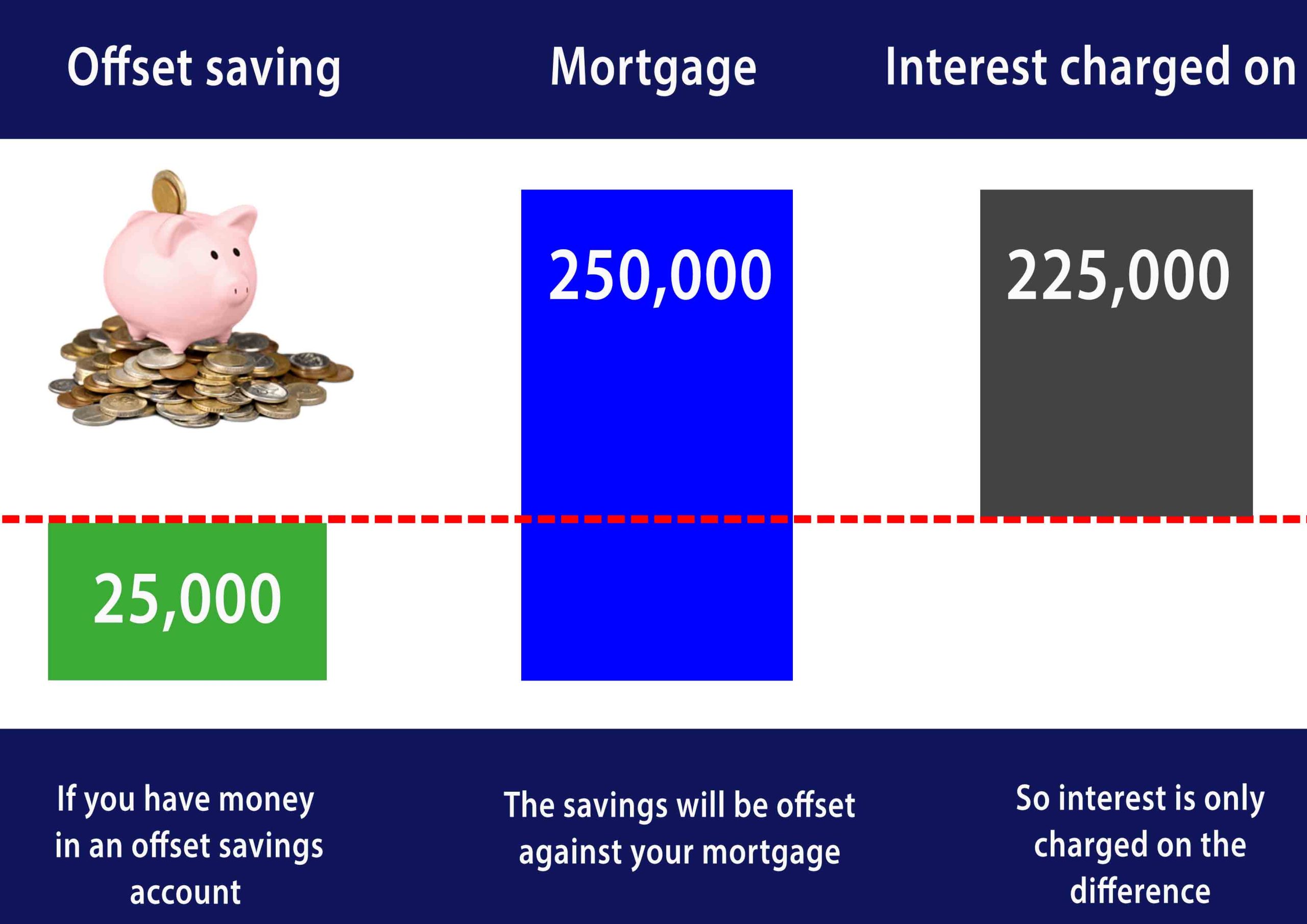

At its core, the offset mortgage is a basic mortgage like any other, but the way the mortgage allows you to use other available cash or savings balances to “Offset” against your existing mortgage is where it really can make a significant difference.

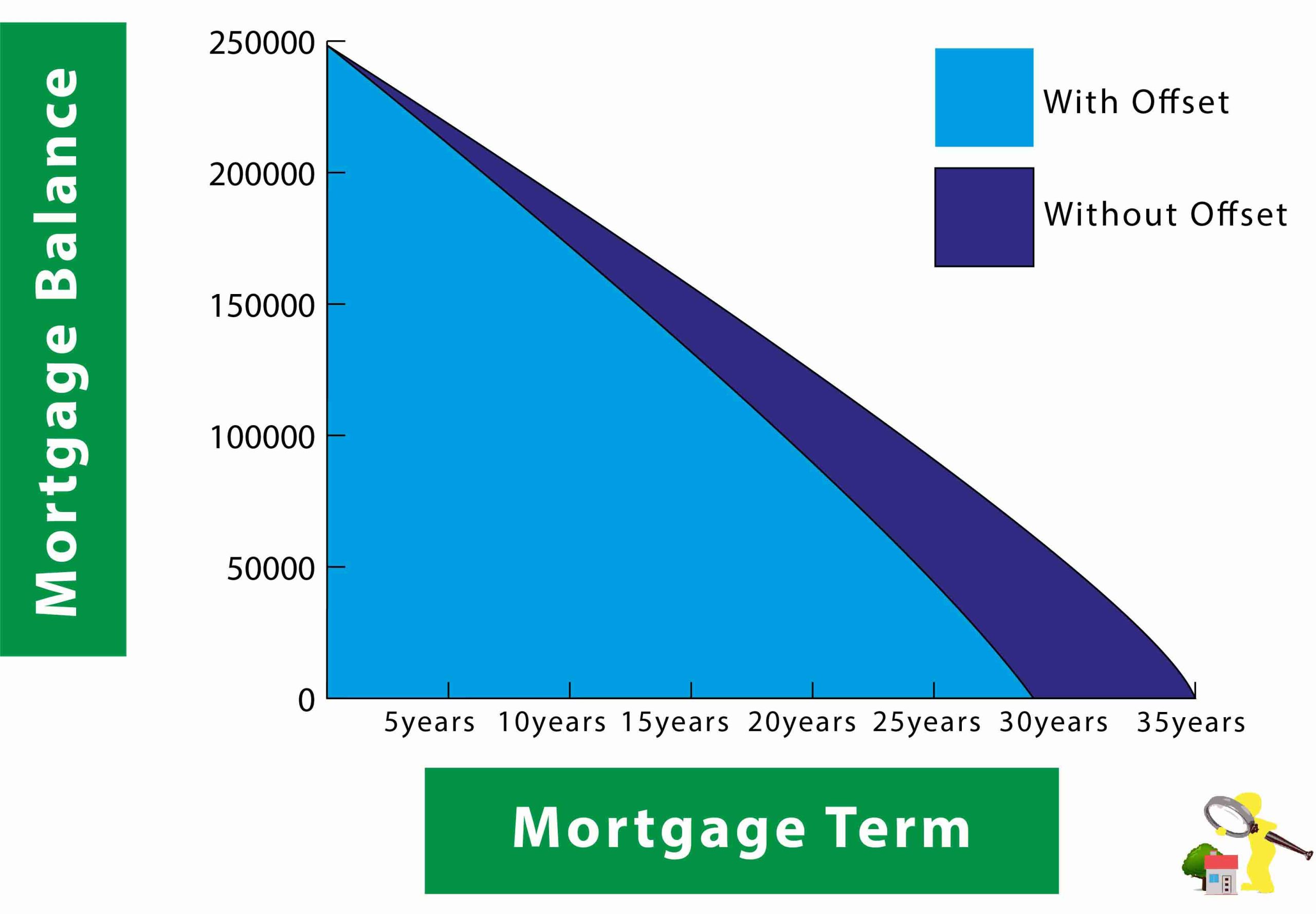

You can save THOUSANDS in interest with an Offset mortgage and repay your mortgage EARLIER by years!

Used correctly, the Offset mortgage really can make the most of your finances and no longer do you have to have funds which you can’t invest sitting around earning little to no interest. Now you can really make your money work hard for you.

How Can a Mortgage Broker Help?

Mortgage brokers are experts in navigating the complex world of mortgages. Here’s how a broker can be instrumental in securing an offset mortgage:

Finding the Right Deal

Brokers compare mortgage products from various lenders to find the offset mortgage with the most competitive interest rate and terms that suit your financial situation.

Eligibility Assessmen

A broker can assess your eligibility for an offset mortgage based on your income, creditworthiness, and deposit amount.

Application Process

Brokers streamline the application process by gathering necessary documents, liaising with lenders, and ensuring a smooth application journey.

Negotiation

Brokers can leverage their relationships with lenders to negotiate favourable terms on your behalf.

This is achieved in 2 ways that ultimately reduce the interest you’re charged, but you decide which option you want for your mortgage:

- Reduce your mortgage payments

- Reduce your mortgage term

So how does it work, well the easiest way to consider the offset mortgage is to imagine that your mortgage is one big overdraft (like the one you likely already have with your current account) and that just like an overdraft if you pay funds into it, you reduce the outstanding balance and therefore the interest you would be otherwise charged as you’re reducing the outstanding balance.

The offset mortgage is different to just simply making overpayments on your mortgage.

Overpayments are a one-way ticket for your funds as once you’ve made that overpayment to ask for the lender to allow you access to that again essentially means a new mortgage application for additional borrowing from the property.

So in practice, it’s a one-way ticket for the overpayment, but the offset mortgage works very differently; you always have access to any and all your savings instantly, they’re not tied in or have any notice periods.

3 main Benefits of Offset Mortgages

- Reduced Interest Payments: The core advantage is the potential to save a significant amount of money over the mortgage term by reducing the interest you pay.

- Increased Flexibility: You can easily add to or withdraw from your offset savings account, allowing you to manage your finances effectively. For example, you could save for a vacation or a home improvement project without impacting your mortgage payments.

- Potential to Repay Faster: By saving on interest, you can potentially pay off your mortgage sooner. You can choose to use the savings to make larger monthly payments and shorten the mortgage term.